-

Integration

-

- I've updated my employees, customers, etc in QuickBooks, but I'm not ready to export time and expense entries yet.

- Can I edit entries that have already been synced?

- Can I use Minute7 if my company uses QuickBooks Online Edition?

- Changing the Account Manager in Minute7 (QuickBooks Online Accounts)

- Error message, "QuickBooks Online could not add time and expense entries because your QuickBooks Online account does not have time tracking enabled"

- Getting started: Sync Minute7 with QuickBooks Online for the first time

- How can I assign QuickBooks classes to my time entries?

- How can I delete or edit entries that have been synced with QuickBooks

- How do I change my security settings for Minute7 in QuickBooks?

- How do I change the number of hours Minute7 waits after an entry is created before exporting it?

- How do I set up my Minute7 account to sync with QuickBooks Online Edition?

- How do I transfer time entries to invoices?

- I've synced with Minute7 with QuickBooks, but Minute7 still tells me I need to sync before I can start using it.

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Online and track time in Minute7.

- User guide: How to sync Minute7 with QuickBooks Online for the first time.

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- What is QuickBooks Web Connector?

- What versions of QuickBooks Online Edition will work with Minute7?

- What will Minute7 change in my QuickBooks file?

- When I sync, I get the error message, "The record of Minute7 connection in QuickBooks Online couldn't be found..."

- Which versions of QuickBooks does Minute7 work with?

- Show Remaining Articles (8) Collapse Articles

-

-

- Can I automatically sync Minute7 and QuickBooks at specific intervals?

- Can Minute7 associate QuickBooks payroll items with time entries?

- Getting started: Sync Minute7 with QuickBooks Desktop for the first time

- How can I assign QuickBooks classes to my time entries?

- How do I add payroll items and rates for an Employee in QuickBooks?

- How do I allow my employees to edit payroll items for time entries?

- How do I change my security settings for Minute7 in QuickBooks?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- I've synced with Minute7 with QuickBooks, but Minute7 still tells me I need to sync before I can start using it.

- Syncing Minute7 with QuickBooks using the QuickBooks Web Connector

- User guide: How to add a payroll item into QuickBooks Desktop and Minute7

- User guide: How to add Payroll items to Minute7 and make a Default Payroll for a User

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- User guide: How to enter a service item into QuickBooks Desktop and Minute7

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time.

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- What version of QuickBooks works with the web connector?

- When I select an Employee for a Minute7 user, I see a note that says "QuickBooks does not know the payroll status of this employee." What does this mean?

- Which versions of QuickBooks does Minute7 work with?

- Show Remaining Articles (7) Collapse Articles

-

- I've updated my employees, customers, etc in QuickBooks, but I'm not ready to export time and expense entries yet.

- Can I automatically sync Minute7 and QuickBooks at specific intervals?

- Can I edit entries that have already been synced?

- Getting started: Sync Minute7 with QuickBooks Desktop for the first time

- How can I delete or edit entries that have been synced with QuickBooks

- How do I change my security settings for Minute7 in QuickBooks?

- How do I change the number of hours Minute7 waits after an entry is created before exporting it?

- How do I get my timesheets and time entries into QuickBooks?

- How do I set up an Employee to use time data to create paychecks in QuickBooks?

- How do I transfer time entries to invoices?

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time

- User guide: How to sync Minute7 with QuickBooks Desktop for the first time.

- What version of QuickBooks works with the web connector?

- What will Minute7 change in my QuickBooks file?

- Which versions of QuickBooks does Minute7 work with?

-

- What should I do if I get a QuickBooks Web Connector error "QBWC1085"

- Error: QuickBooks Desktop – Time Tracking Not Enabled

- Error: QuickBooks is having trouble determining the payroll status for one of your employees

- Error: QuickBooks is having trouble finding payroll information for on of your employees who has "Use time data to create paychecks" enabled

- Which versions of QuickBooks does Minute7 work with?

-

-

- Articles coming soon

-

-

Timekeeping

-

- Can I have users and time entries associated with vendors?

- How can I assign QuickBooks classes to my time entries?

- How can I enter billable and unbillable time?

- How do I control whether my time entries are grouped by week or shown individually?

- How do I get my timesheets and time entries into QuickBooks?

- How do I restart my timer?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- How do I set up an Employee to use time data to create paychecks in QuickBooks?

- I don't see any of my employees or customers

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- User guide: How to enter a 1099 into QuickBooks Online and track time in Minute7.

- User guide: How to enter and track time with Minute7.

- User guide: How to mark an entry as billable or non-billable in Minute7.

- What are "approved" and "disapproved" time entries?

- What do I need to do before my employees begin entering time?

- What do I need to do before my employees begin entering time?

- What if I don't want to track expenses?

- Show Remaining Articles (2) Collapse Articles

-

-

Expense Management

-

- How to track your Credit Card Expenses with Minute 7?

- How to track your Reimbursable Expenses with Minute 7?

- The billing status of my expenses is not always showing up in QuickBooks. Why not?

- User guide: How to batch process time and expense entries in Minute7.

- User guide: How to enter and track expenses in Minute7.

- User guide: How to mark an entry as billable or non-billable in Minute7.

- What are expenses? How do they work in QuickBooks?

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- Who can enter expenses?

- Why associate an Employee with an "Associated Vendor for expense tracking in QuickBooks"?

-

-

Minute 7 Mobile App

-

Reporting

- Articles coming soon

-

Account Administration

-

- Changing the Account Manager in Minute7 (QuickBooks Desktop Accounts)

- How do I allow my employees to edit payroll items for time entries?

- How Do I remove a user from my account?

- How do I set the default payroll item that is used when an employee creates a time entry in Minute7?

- User guide: How to add Payroll items to Minute7 and make a Default Payroll for a User

- User guide: How to assign classes in Minute7

- User guide: How to Associate a Minute7 User With a QuickBooks Employee or Vendor.

- User guide: How to enter a 1099 into QuickBooks Desktop and track time in Minute7

- What is an "Associated Vendor for expense tracking in QuickBooks"?

- When I select an Employee for a Minute7 user, I see a note that says "QuickBooks does not know the payroll status of this employee." What does this mean?

-

-

- Can I change the permissions of the account manager?

- Can I limit which "Customer: Jobs" a user can see?

- Can I limit which "Customer: Jobs" a user can see? Copy

- Can I limit which of my "Service Items" a user can see?

- How do Permissions work?

- User guide: How to Set Up Restrictions for Users.

- What happens if I don't associate a user with an employee?

- Why can't I see all of my employees in the drop-down list when I am trying to set up a user account?

-

-

-

- What should I do if I get a QuickBooks Web Connector error "QBWC1085"

- Error: QuickBooks Desktop – Time Tracking Not Enabled

- Error: QuickBooks is having trouble determining the payroll status for one of your employees

- Error: QuickBooks is having trouble finding payroll information for on of your employees who has "Use time data to create paychecks" enabled

-

-

No Integration

How to track your Credit Card Expenses with Minute 7?

Credit Card Expenses

Expense tracking is much easier with Minute 7 as it allows users to track both reimbursable and credit card expenses.

Credit Card Expenses:

Credit card expenses are those expenses purchases have been made by a company issued credit card. Since these expenses have already paid for, your company does not want to generate a bill for them in your QuickBooks company file. Therefore, once approved by the manager, all credit card expense entries are synced as “Paid” in QuickBooks.

Example

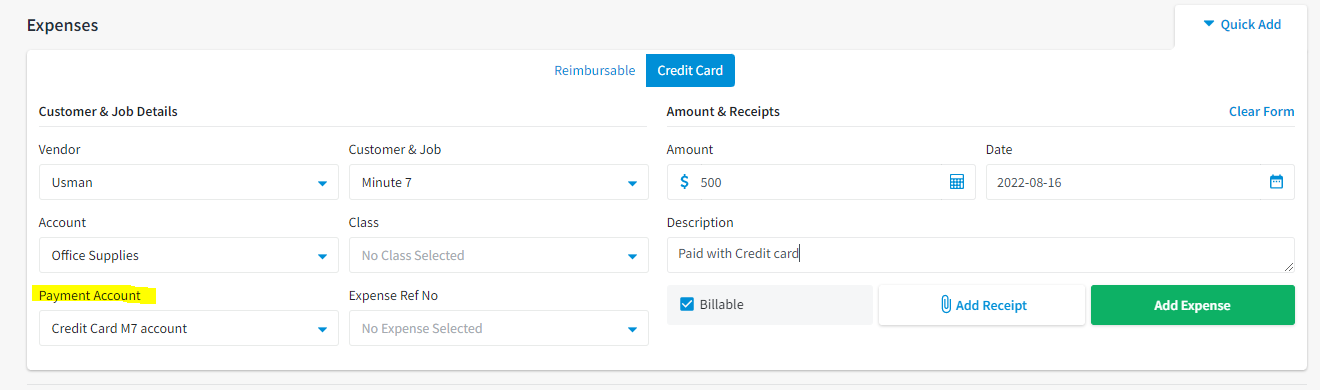

A vendor purchased $500 in office supplies on a company issued credit card, in this situation, the vendor would need to select a payment account from which an expense was paid as shown in the screenshot below: Therefore, a credit card expense entry in Minute 7 will look like:

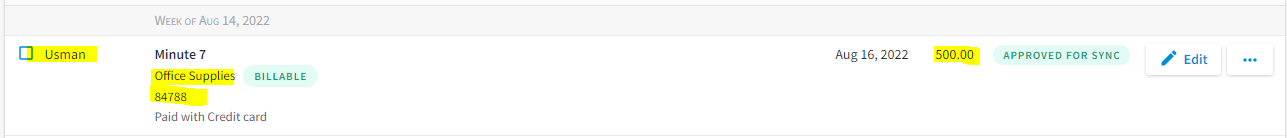

Therefore, a credit card expense entry in Minute 7 will look like: Once this record is approved and synced by the manager; the expense will be displayed with type “CC charge” and status “Paid” in QuickBooks.

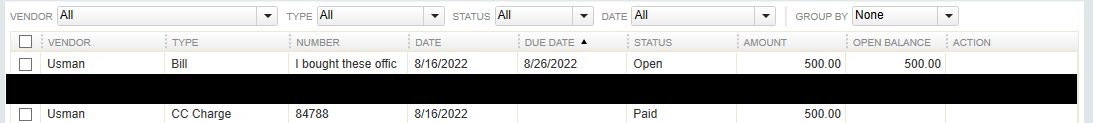

Once this record is approved and synced by the manager; the expense will be displayed with type “CC charge” and status “Paid” in QuickBooks.

Difference Between Credit Card and Reimbursible Expense Entries:

You can see the difference in QuickBooks Desktop by noticing the different status and type of two expense entries when synced with QuickBooks below: